- Life Insurance

- Income Protection

- Superannuation

- Superannuation Insurance

- Super Fund Income Protection

- SMSF Insurance

- SMSF Life Insurance

- SMSF Income Protection

- Wealth Smart’s Superannuation Employer Contribution Solutions

- Super Centre

- Consolidating Your Super

- What is Super?

- Salary Sacrificing Super

- Concessional contributions cap

- Your Investment Strategy

- Our Solutions

- Corporate Employee Solutions

- Private Client Solutions

- General Insurance

- Resources

- Insurers

- Contact

- Superannuation Insurance

- Super Fund Income Protection

- SMSF Insurance

- SMSF Life Insurance

- SMSF Income Protection

- Wealth Smart’s Superannuation Employer Contribution Solutions

- Super Centre

- Consolidating Your Super

- What is Super?

- Salary Sacrificing Super

- Concessional contributions cap

- Your Investment Strategy

- Our Solutions

- Corporate Employee Solutions

- Private Client Solutions

Recent Posts

Categories

What is salary sacrifice into Super and how does it benefit you?

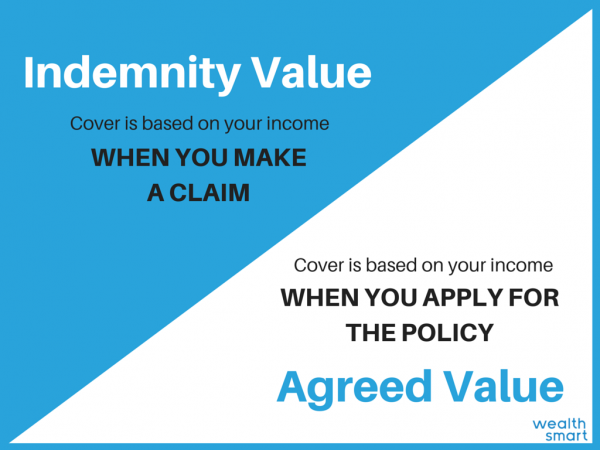

Agreed vs Indemnity Value Cover

OK. You’ve chosen to invest in Income Protection insurance so you can have peace of mind that you and your family will remain financially secure even in times of hardship. But one of the first things you’ll have to think about when selecting your Income Protection policy is whether you want agreed value cover or indemnity value cover.

There’s no doubt these terms are confusing. And they are vital to determine which level of premium and cover you’ll receive. If you haven’t come across these terms before, you’ll want to familiarise yourself with how agreed or indemnity value covers work and which will be best for your situation before you apply for an Income Protection insurance policy.

Indemnity value cover

With indemnity value, your cover is calculated on your income at the time you make a claim. When you apply for Income Protection insurance, you’re insured for what you say you earn. But when you go to make a claim, you have to provide proof of that income.

Benefits of indemnity value cover

Indemnity value cover ensures:

- A simplified application process, since no proof of income is required at that time

- Significantly lower premiums

- Coverage of up to 75% of your pre-claim earnings. This is usually determined by your average monthly income for a number of consecutive months for two or three years before you made your claim.

Disadvantages of indemnity value cover

- Your cover corresponds with your income at the time of a claim, so if your income has reduced since you applied for the policy, your cover will also be reduced.

Should I choose indemnity value cover?

Indemnity value cover is best for those with a stable income likely only to rise. As an employee, it’ll be easy for you to prove your income with a payslip when you make a claim.

Agreed value cover

With agreed value, your cover is calculated on your income at the time you apply for the policy. You have to prove your income at the time of applying. Then you’ll be insured for a set amount agreed upon by you and your insurer.

This amount is typically based on an average of your last two tax return statements.

Benefits of agreed value cover

Agreed value cover ensures:

- You know what benefit you’ll receive, even if your income changes. You’ll be protected if your income drops.

- If you do find that your income increases substantially, you can change your policy at any time.

Disadvantages of agreed value cover

- Higher premium rates. Premium rates can be 20% more expensive than indemnity value policies, because it gives you greater security.

Should I choose agreed value cover?

If you have a fluctuating income, agreed value cover is the better choice to lock in an agreed-upon amount of cover for the life of your policy. That way if your income decreases, your cover remains the same. Freelancers, self-employed and small business owners best suit this policy.

Agreed value cover can also be beneficial to working women looking to have kids in the future. If they want to take maternity or even unpaid leave, they may be facing a lower income when they return to the workforce.

How do I know which policy is right for me?

Agreed value and indemnity value cover are substantially different policies, providing you with different premiums and a pre-arranged cover plan from your application until your policy ends.

To know which policy is right for your circumstances, you need to think about your budget and how you are employed and receive your income.

Of course, it’s worthwhile speaking to an insurance expert to clarify any concerns you might have. Contact us at Wealth Smart for invaluable advice, or seek a quote today.