Concessional contributions are money paid to your super fund and are subject to a low rate of tax. Since these fall under a lower tax regime, the government has put a cap or limitation on such contributions. Hence concessional contribution cap actually helps you systematically build a secure super fund.

Concessional contributions include:

- employer contributions (including contributions made under a salary sacrifice arrangement)

- personal contributions claimed as a tax deduction.

If you have more than one fund, all concessional contributions made to all of your funds are added together and counted towards the concessional contributions cap.

|

Table 1.1: Concessional contributions caps |

|||

|

Income year |

Date |

Your age at this date |

Your concessional contribution cap |

|

2019–20 |

|

All ages |

$25,000 |

|

2018–19 |

|

All ages |

$25,000 |

|

2017–18 |

|

All ages |

$25,000 |

|

2016–17 |

30 June 2016 |

<49 |

$30,000 |

|

2016–17 |

30 June 2016 |

49+ |

$35,000 |

|

2015–16 |

30 June 2015 |

<49 |

$30,000 |

|

2015–16 |

30 June 2015 |

49+ |

$35,000 |

|

2014–15 |

30 June 2014 |

<49 |

$30,000 |

|

2014–15 |

30 June 2014 |

49+ |

$35,000 |

|

2013–14 |

30 June 2013 |

<59 |

$25,000 |

|

2013–14 |

30 June 2013 |

59+ |

$35,000 |

Excess concessional contributions from 2013–14 onwards are included as taxable income, taxed at the marginal tax rate plus an excess concessional contributions charge

|

Table 1.2: Concessional contributions caps |

|||

|

Income year |

Date |

Your age at this date |

Your concessional contribution cap |

|

2012–13 |

|

All ages |

$25,000 |

|

2011–12 |

30 June 2012 |

<50 |

$25,000 |

|

2011–12 |

30 June 2012 |

+50 |

$50,000 |

|

2010–11 |

30 June 2011 |

<50 |

$25,000 |

|

2010–11 |

30 June 2011 |

+50 |

$50,000 |

|

2009–10 |

30 June 2010 |

<50 |

$25,000 |

|

2009–10 |

30 June 2010 |

+50 |

$50,000 |

|

2008–09 |

30 June 2009 |

<50 |

$50,000 |

|

2008–09 |

30 June 2009 |

+50 |

$100,000 |

|

2007–08 |

30 June 2008 |

<50 |

$50,000 |

|

2007–08 |

30 June 2008 |

+50 |

$100,000 |

For 2012–13 and earlier years, excess concessional contributions were taxed at 46.5% (15% levied in the super fund, with an additional 31.5% payable). Hence if you are not careful about super concessional contribution cap, you may reduce your savings through additional taxes.

Your annual superannuation concessional contributions cap may be relaxed under certain circumstances. Read on to find out.

UNUSED CONCESSIONAL CAP CARRY FORWARD

From 1 July 2018, if you have a total superannuation balance of less than $500,000 on 30 June of the previous financial year, you may be entitled to contribute more than the general concessional contributions cap and make additional concessional contributions for any unused amounts.

The first year you will be entitled to carry forward unused amounts is the 2019–20 financial year. Unused amounts are available for a maximum of five years, and after this period will expire.

A definite advantage of this arrangement is that you do not have to cut down on essential expenses to contribute to a super fund if for some reason you face sudden financial distress.

|

Table 2: Unused concessional cap carry forward |

|||||

|

Description |

2017–18 |

2018–19 |

2019–20 |

2020–21 |

2021–22 |

|

General contributions cap |

$25,000 |

$25,000 |

$25,000 |

$25,000 |

$25,000 |

|

Total unused available cap accrued |

Not applicable |

$0 |

$22,000 |

$44,000 |

$69,000 |

|

Maximum cap available |

$25,000 |

$25,000 |

$47,000 |

$25,000 |

$94,000 |

|

Superannuation balance 30 June prior year |

Not applicable |

$480,000 |

$490,000 |

$505,000 |

$490,000 |

|

Concessional contributions |

nil |

$3,000 |

$3,000 |

nil |

nil |

|

Unused concessional cap amount accrued in the relevant financial year |

$0 |

$22,000 |

$22,000 |

$25,000 |

$25,000 |

Note: This Table assumes no indexing of general cap.

By now you must have found a satisfactory reply to a common question investors often have – What is a concessional contributions cap? Now it’s time to find out about a different type of cap to super contributions.

NON-CONCESSIONAL CONTRIBUTIONS CAP

Non-concessional contributions include personal contributions for which you do not claim an income tax deduction.

If you have more than one fund, all non-concessional contributions made to all of your funds are added together and counted towards the non-concessional contributions cap.

|

Table 4: Non-concessional contributions cap |

|

|

Income year |

Amount of cap |

|

2019–20 |

$100,000 see Note 1 |

|

2018–19 |

$100,000 see Note 1 |

|

2017–18 |

$100,000 see Note 1 |

|

2016–17 |

$180,000 |

|

2015–16 |

$180,000 |

|

2014–15 |

$180,000 |

|

2013–14 |

$150,000 |

|

2012–13 |

$150,000 |

|

2011–12 |

$150,000 |

|

2010–11 |

$150,000 |

|

2009–10 |

$150,000 |

|

2008–09 |

$150,000 |

|

2007–08 |

$150,000 |

Note 1: The non-concessional cap for an income year is a multiple of the concessional contributions cap.

From 1 July 2017, your non-concessional cap is nil – for a financial year – if you have a total superannuation balance greater than or equal to the general transfer balance cap ($1.6 million) at the end of the previous financial year. In this case, if you make non-concessional contributions in that year, they will be excess non-concessional contributions.

If you are under 65 years old, you may be able to make non-concessional contributions of up to three times the annual non-concessional contributions cap in a single year. If eligible, when you make contributions greater than the annual cap, you automatically gain access to future year caps. This is known as the ‘bring-forward’ option.

From 1 July 2017 your total superannuation balance at the end of the previous financial year will determine:

- the non-concessional contributions cap you can bring forward and

- whether you have a two-year or three-year bring-forward period.

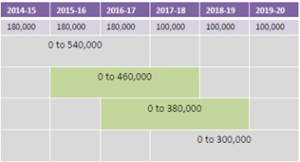

If you enter a bring forward arrangement in either the 2012–13 or 2013–14 financial year you will be locked into a $450,000 cap over three years; however, in the 2014–15 financial year your bring forward cap is $540,000.

From 1 July 2017, the bring-forward amount and period is dependent on your total superannuation balance on the day before the financial year contributions that trigger the bring forward.

Transitional period transitional arrangements apply if you triggered a bring forward in either the 2015–16 or 2016–17 financial years. If you have triggered a bring forward before 1 July 2017 and you have not fully utilised your bring-forward cap before 1 July 2017, your cap will be reassessed on 1 July 2017 to reflect the new annual cap.

During the transitional periods (highlighted in the following table), contributions made prior to 1 July 2017 will affect your total non-concessional contributions capacity over the following two years.

CGT CAP AMOUNT

Under the CGT cap, you can during your lifetime exclude non-concessional super contributions from the non-concessional contributions cap up to the CGT cap amount. The CGT cap applies to all excluded CGT contributions, whether they were made between 10 May 2006 and 30 June 2007 or after 30 June 2007.

The CGT cap amount is indexed in line with average weekly ordinary time earnings (AWOTE), in increments of $5,000 (rounded down). The new indexed amount is generally available each February.

If you would rather meet a salary sacrifice concessional contributions cap, the final decision would depend on your employer and your age.

GET IN TOUCH

Connect with us for all information regarding the Australian superannuation concessional contribution cap. We will walk every step with you to help you understand and apply the cap on concessional superannuation contributions to maximise your savings and to build a secure retirement fund. Call us at 1800 765 100.

FAQ

What is the Super cap for 2021?

From July 2021, the concessional cap is $27,500 pa regardless of age. The non concessional cap is $110,000 pa.

What happens if I exceed my concessional contribution cap?

We strongly suggest speaking with your accountant or giving us a call if you believe you have exceeded the contribution cap within a financial year.

Can I put lump sum into super?

Yes, salary sacrifcing is not the only way to inject funds into your super fund. You are also able to make a non concessional lump sum payment from your bank account at anytime. Usually via Bpay.Give us a call and we can step you through the differences between concessional and non concessional payments.